Can We Now Have More Confidence in the eCommerce Market?

)

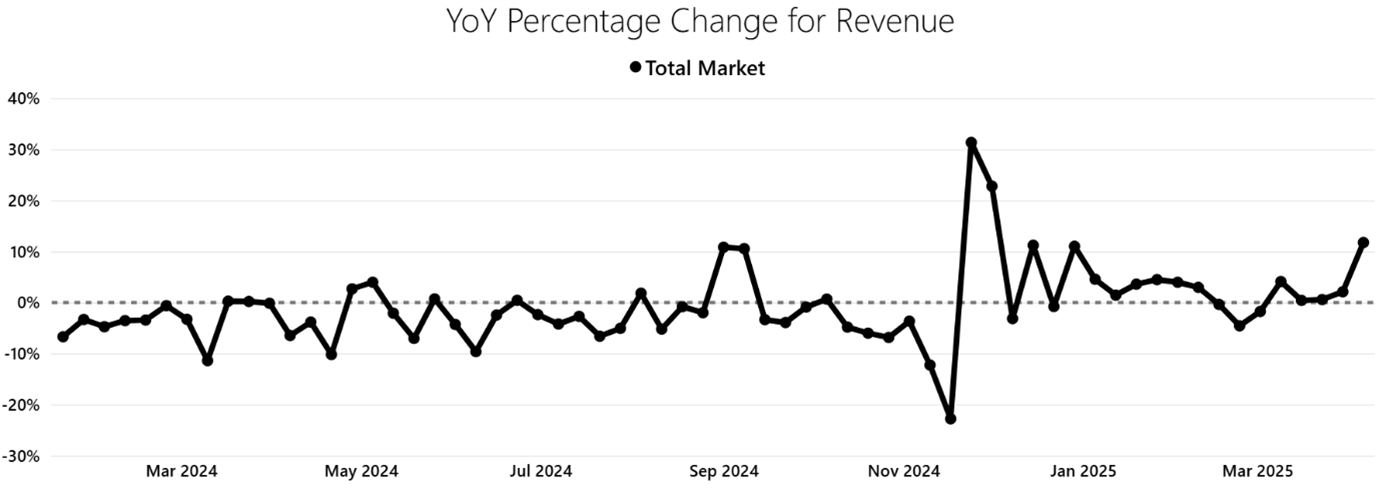

A few months’ ago, in this very series, I posited the idea that eCommerce might be making a bit of a comeback following years in the growth wilderness. The early weeks of the year were all positive for revenue growth, but this was against some quite strong declines for the same period in 2024, so any suggestion that it might be returning to something more reliably positive felt rather tentative.

Here we are though with a few more weeks under 2025’s belt, taking us up to almost a third of the year done, and a strange vision has been popping its head above the waves without sinking straight back down and drowning again moments later; confidence.

This is one of those moments where you almost don’t want to say it out loud, lest it curses the recovery, but the revenue growth line in the below chart from the start of this year has been very solid and reliable compared to where it was in the year previous. In 2024 it was rare to see even two consecutive weeks above the base line, let alone 13 of the first 15.

And those two weeks of negative growth are not the cause for concern that they may first appear. Every year there are significant retail events that move in the calendar, with Mothers’ Day and Easter being two of the major ones. Both of those went back in the calendar by almost three weeks this year compared to 2024, so the decline for growth in March 2025 was actually due to the weeks leading up to Mothers’ Day not aligning and showing a skewed like-for-like.

Likewise, the final week on the graph shows where Easter moved, so the promotional activity that accompanies it produced growth of over 11%; crucially though, the weeks before that when we might have expected a negative impact due to the non-date alignment of Easter did not show a notable decline. This means that, on balance, Easter trading seems to have been pretty good.

To quantify how good trade has been thus far, our forecast for revenue growth in 2025 was +1%; year-to-date, it is running at +2.9%. It is early days still and there is a lot of ground to cover, but you can’t help but feel encouraged by the start the market has made.

Category Winners and Losers: A Mixed Bag Beneath the Surface

It’s not been across all categories the same though. Health & beauty has been buoyant for 18 months now and continues to perform very well, with fragrance a particular standout. Home & garden has been positive for most of 2025 to date, with furniture doing well and garden benefitting from the sunny weather. Electrical has seen some sub-categories selling well while other struggled, but overall it has been more up than down. Pre-orders for the Nintendo Switch 2 seem to have boosted gaming and computing.

On the other side, gifts has been the worst-hit category for a number of years now but even this one has just seen five weeks of consecutive growth for the first time since 2021. Clothing is experiencing the toughest conditions however, with only footwear seeing more positive growth than negative while womenswear and menswear have hardly seen any positive growth all year. The real reasons may be multiple and complex, but it does feel like Vinted might be exerting a good deal of influence here.

It can all turn around, it’s quite possible that the global economy falls into recession this year and the UK might have to navigate a difficult period, but there’s no denying that the ecommerce market is appearing more resilient and reliable than it has done in a long time.

Looking at the above graph, there are plenty of times over the coming months where we will be comparing against negative growth from last year, making it easier and more likely that we can secure growth against those periods. There are some positive weeks to come up against too, so it won’t be growth all the way through and Black Friday did pretty well last year so we won’t stay at +2.9% until the end of the year.

Still, it’s nice to have a buffer. Now that’s confidence for you.

Latest News

-

Biotiful's Rob Manning on Spearheading DTC in the rapidly growing gut health market

01 May 2024 Laura DazonMeet Robert Manning, Head of Direct to Consumer & eCommerce at Biotiful, who's spearheading the launch of ambient products through DTC channel in the rapidly growing gut health market. -

In a recent conference session, Andrew Ostcliffe, Oxfam's Head of eCommerce & Retail Innovation, shared key strategies for managing rapid eCommerce growth while integrating with physical store offerin ...

-

In this conference Helen Slaven, Chief Revenue Officer at Poq, and Jennifer North, Head of Digital Experience at Hobbycraft, shared valuable insights into the pivotal role of mobile apps in driving cu ...

-

Are things looking up for eCommerce?

30 Apr 20242024 started off badly for eCommerce sales in the UK and it looked like demand might actually be getting even more suppressed; a real blow to a market that has seen 35 consecutive months of negative m ... -

If you haven’t started your entries already to the eCommerce Awards there is still plenty of time to start your winning journey…

-

Recognising excellence in the world of eCommerce the ceremony will take place after day one of eCommerce Expo.

-

Martin Musiol from GenerativeAI.net on Finding Tailored Solutions For Your Business With AI

27 Mar 2024 Laura DazonExplore Martin's journey into AI, and discover his insights on integrating AI into business operations and how can AI enhance creativity. -

The 3 Keys to Success in eCommerce Right Now

27 Mar 2024Learn eCommerce success essentials from Chloë Thomas: adapt, profit, engage. Test and innovate to thrive in today's competitive market. -

What's wrong with online fashion?

27 Mar 2024 Andy Mulcahy, Strategy and Insight Director, IMRGAs I mentioned in a previous article, eCommerce is going through a tough period at the moment. Following the huge growth online during the lockdowns, it has fallen away consistently as we’ve entered a ... -

ECommerce Talent: Past, Present & Future

27 Mar 2024Discover essential insights into eCommerce talent sourcing trends with Andy Davies, from Vertical Advantage. Learn about salary shifts, leadership gaps, and strategies for sustainable growth. -

Are You Strategising Growth This Year?

04 Mar 2024IMRG’s recent session highlighted key insights for eCommerce growth: 🎧 Listen to the Full Session In This Session: eCommerce Downturn: 2022 saw negative growth in the UK's eCommerce sector, largel ... -

Learn how to go composable with Lampoo, luxury second-hand fashion retailer.

-

A tough, tough start to the year for online retailers

27 Feb 2024 Andy Mulcahy, Strategy and Insight Director, IMRGWith trading conditions proving to be very difficult over the past few years, it was perhaps a surprise that peak trading fell in line with forecasts for online retail. -

Discover key insights with Paul Walsh, Founder of All Things Amazon.

-

Trustpilot's Paul Kirby On Leveraging The Power Of Reviews For Your Business

23 Feb 2024 Laura DazonMeet Paul Kirby, Trustpilot's Enterprise Customer Success Manager, sharing his journey from media advertising to guiding eCommerce leaders through reviews. -

IMRG reveal industry customer acquisition rates, how long customers should be staying with you, and if you’re spending too much to acquire new customers. This session uses IMRG’s unique market dataset ...

-

Manuel Tonz from Bloomreach on Holistic Commerce and Conversational AI

05 Feb 2024 Laura DazonMeet Manuel, the Director of Client Strategy at Bloomreach. -

How to Win the Connected Customer Experience

04 Feb 2024Brands that succeed in 2024 are likely to be those that connect brand and customer experiences seamlessly, digitally and physically in everyday life: at home, in play, in retail, and more. Faced with ... -

A pretty good Christmas for retailers, but… For many retailers selling in the UK market, the past few years have been notable for a clear dip in customer demand; the economic downturn has been reflec ...

-

What does it take to gain 1 million active mobile app users monthly? How do you reach the ability to deploy any applications or API changes worldwide in 5 minutes or less? Well, Formidable’s Director ...

-

Discover the secrets behind Pandora's colossal success as the world's largest jewellery brand in a session titled "How Product Information Management Powers Pandora's Global Retail Growth." The world’ ...

-

Explore the dynamic landscape of Cross-Border eCommerce and its role in unlocking global growth. This expert panel discusses key strategies, technologies, and trends, offering valuable insights for bu ...

-

How to Take An Established Brand to New Markets

22 Jan 2024Moonpig's Director of New Markets & Ventures, Alexander Toft, shared invaluable insights during the conference session on "Taking an established brand to new markets." Here are the key takeaways: Star ... -

The Livestreaming eCommerce market in China is forecast to reach 700bn RMB (£80bn) in 2023, roughly equivalent to the entire eCommerce market of South Korea. Chinese consumers show an increasing appet ...

-

Are you sold on retail media?

10 Jan 2024Discover key insights with experts from Propeller, Boots Media Group, Microsoft and NielsenIQ -

Trustpilot x Henry Case Study: How the Household Brand Boosted its Growth Through Reviews

10 Jan 2024Henry is a fixture in millions of homes in the UK, and part of their success can be attributed to the hyper-focused view on their customers’ experience and loyalty. -

A checklist for improving your key KPIs with Composable commerce while avoiding the most common pitfalls - drawing from practical experience from Lars Petersen, CEO of Uniform, Tomas A. Krag and Malgo ...

-

In today's highly competitive world, where customers have numerous options and heightened expectations, retailers face the challenge of fostering mutually valuable and long-term relationship with thei ...

-

In this session, uncover how Sitecore Commerce breaks away from the one-size-fits-all approach, empowering brands with unique products to maintain their distinctiveness and deliver unmatched customer ...

-

eCommerce Deep-Dive with Andy Mulcahy from IMRG

11 Dec 2023 Andy MulcahyExplore the aftermath of Black Friday 2023 with Andy Mulcahy's analysis.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)